On this page:

Popular searches

Log into your account

Travel and Insurance

Posting

What is fraud?

Fraud is when deception is used to gain a dishonest financial or personal advantage. Many fraudsters will achieve this using scams.

A scammer’s aim is to make you trust them and convince you they are who they pretend to be. Unfortunately, they’re constantly finding new ways to trick people. So, it’s important to be aware of their tactics and how to protect ourselves.

Think you’ve been the victim of a scam or fraud?

Signs it might be a scam

Signs of scams to watch out for and be wary of include:

- Receiving a phone call, text message or email telling you to make a transfer, deposit or send money to a stranger or a company

- Being asked to send cash via a money transfer service like Western Union to someone you haven’t met in person

- Being asked to buy foreign currency or withdraw money and told to hand it over to a courier or send it in the post

- Being told to buy a gift card and send the card details and code to a stranger

- Being made to feel there’s a sense of urgency or problem that needs your immediate action

- Being told not to tell anyone what you’re being asked to do

- Someone staying on the phone with you while you complete a transaction they’ve asked you to do

Scams that pretend to be Post Office

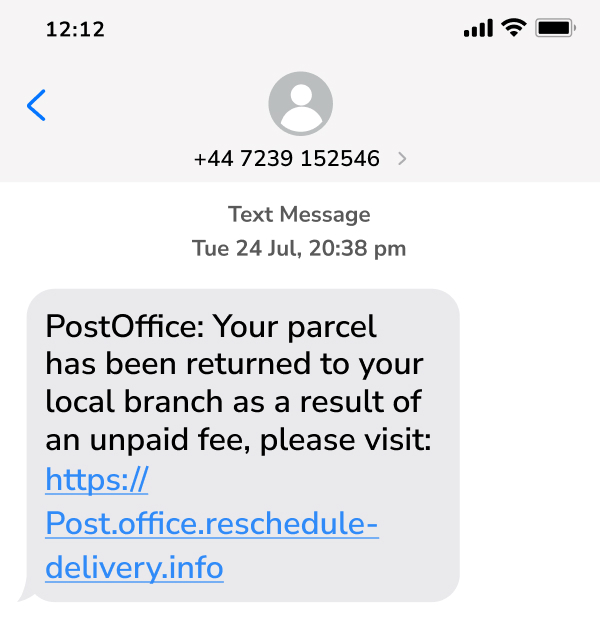

Emails or texts about mail

If you receive a text message or email that claims to be from Post Office about the delivery of your mail, you must ignore it. Please don’t click on any links it contains.

We'll never send you a message about the delivery or redelivery of an item of mail, including a request for unpaid postage fees.

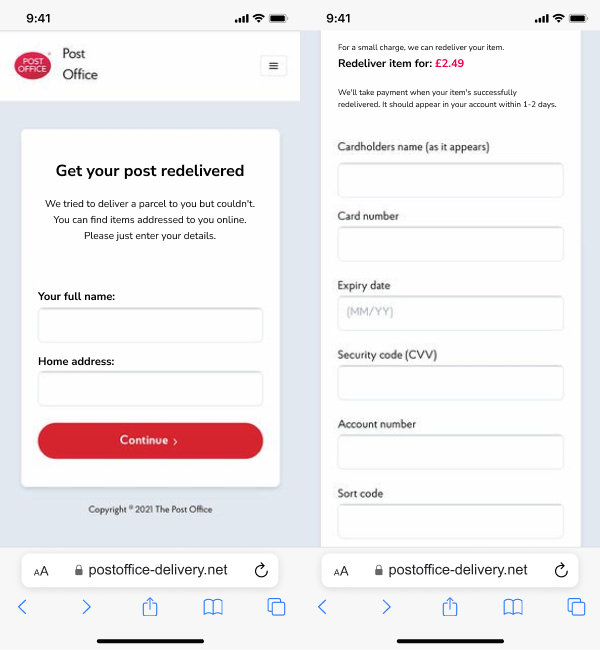

Fake Post Office branded websites

Here's an example of a fake website using the Post Office brand. Links to such sites are usually sent in email or text messages.

This page suggests unpaid fees must be paid before an item can be delivered. But, at Post Office, we don’t handle the delivery or mail or directly request payment for unpaid postage.

Please don’t associate this type of web page or request with Post Office – it’s not.

You should also check the Royal Mail guidance on unsent items scams.

What to do if you suspect a scam

- If you think you have been scammed, please report it. Check and contact the organisation using their official contact details, not the ones provided in any message or over the phone

- If you've received or seen something using the Post Office brand you think is suspicious, inform us by emailing ReportingScams@postoffice.co.uk. We can’t respond to every email, but we'll be in touch if we need more information

- If you're in any doubt about a message or phone call, stop communication immediately

- Don’t feel rushed, panicked or pressured to provide information you're uncomfortable sharing. Official organisations wouldn't pressure you into giving personal details

- If you think a scammer has obtained your bank details or access to your smartphone or computer, call your bank right away. Their phone number will be on the back of your card

Other types of scams to watch out for

Scammers use various other tactics to trick you out of your money or into unwittingly assisting with their crimes.

- Romance scams – This is where victims are contacted by a scammer, either online (eg through dating sites or social media) or in person to gain their trust and build a fake relationship. The scammer will ask victims to send money to help them financially or require access to the victim’s money by their bank account or credit card

- Courier scams – This is where a scammer contacts victims by phone pretending to be a bank official or police officer. The scammer may provide basic information about the victim like full name and address, which is easily obtained. They may advise there is an issue with the victim’s bank account or that the “police” need help with an investigation. After building trust with the target, the scammer will be asked to withdraw money from their account or buy foreign currency or purchase an expensive item to hand over to a courier who will also be a fraudster

- Money mule scams – These are scams where criminals recruit someone to move money obtained from criminal activities to avoid any direct links. They’ll send the money to the mule, asking them to withdraw it and transfer the money to a different account. And they’ll arrange for the mule to keep some of the money for themselves.

Money mules may be recruited unwittingly by responding to a job advert that promises a fast, easy way to earn money. They may not be aware the money they’re sending was illegally obtained but they can still be prosecuted for fraud and money laundering - Phone scams – With these scams, criminals pretend to be from a reputable organisation, claiming your account has been compromised, and action is required

- Phishing scams – This is when someone targets your email account to steal personal information or load malicious software onto your device. ‘Spear phishing’ emails are professionally created to seem personalised. They may ask you to click on a link or input personal details

- Smishing scams – This is the same as phishing but sent via text message instead of email

- Malware scams – Malware takes on many forms, including viruses, trojans, spyware and worms. It’s mainly used to monitor your online activity so criminals can gain access to your passwords or personal details. Malware can be downloaded through links from unsolicited emails, embedded in unofficial software downloads, or even be on a USB stick from an untrusted source

In summary

Look out for these signs of scams and fraud. If something looks at all suspicious, don't click, continue communications or do as it asks. And if you think you've already fallen foul of scammers, report it.

Think you’ve been the victim of a scam or fraud?

Common questions about scams

-

Taking care of yourself online and protecting your devices is a key part of preventing fraud. If you want to know more, we’ve put together a more detailed guide on staying safe online.

Keep your banking details secure

Never share your PIN or online banking login details with anyone. Don’t let anyone see you enter your PIN or password and use secure web pages. Contact your bank or building society immediately if you see a suspicious transaction or receive an unexpected payee request. And always use the log out button when you’ve finished your banking session.

Using email safely

If you receive an unsolicited or suspicious email, check it’s legitimate before taking any action. Never reveal your banking details or personal information in an email. Don’t click on any links, open any attachments or fill out any forms. They could contain viruses or malicious software if not from a genuine source. If you receive a suspicious email, report it to report@phishing.gov.uk.

Create strong passwords

You need a password you can remember but would be difficult for anyone else to guess. Never use obvious details that are easy to find, such as your birthday, and don’t share your passwords with anyone. Consider using a long password (between 20 - 30 characters) and mixing symbols and letters for extra security.

Protect your devices

Set a strong PIN, password or passcode for your device like you’d create a password. Protect your computer by adding up-to-date anti-virus software, using a firewall, and keeping your software up to date. And always download apps from a legitimate source like the official App or Google Play Store.

Use safe websites

Always confirm a web page is genuine and secure, and before entering any information, make sure it offers encryption of your data. Never follow links from a website or email which seem suspicious.

Sharing on social media

The more information you post online, the more you put yourself at risk. Criminals scan social networking sites to find details that might help them access your accounts. Use the privacy and security settings to control who can access your information.

-

Here’s some highlights on how to detect a fraudulent phone call or text and the best ways to look after your information when using your phone. To find out more see our guide to phone safety.

How to avoid phone fraud

Never allow a cold caller to take remote access of your computer or respond to suspicious text messages or click links within one. If you receive a suspicious call, wait at least 10 minutes or use another line to contact the official company number to discuss the call.

Using public Wi-Fi on your phone

If you’re using public Wi-Fi, never enter personal information, read private emails, install any systems, or download or update applications. Use your mobile network or connect your computer to your hotspot.

Keep your information private

Don’t let anyone overhear a private phone call where you might give out personal information or enter confidential details into your phone when someone might be watching.

Keeping your mobile phone safe

Use a strong PIN, password, passcode, or fingerprint detection to access your device. Download apps from a legitimate source like the App or Google Play Store. If your phone is lost or stolen or you want to sell it, wipe all information, and return it to factory settings.