If you’re a going on a cruise you must add our cruise cover upgrade.

Remind yourself how much a cruise holiday costs. It's typically more expensive than a standard trip. A voyage tends to last longer than most holidays too. Cruises carry their own risks and Cruise Cover is there in case the unexpected should happen.

We don’t like to think about what could go wrong, but cruises can have their own, unexpected upsets. Certain things that could happen at sea may not be covered by a standard policy alone and the extra protection is designed specifically to help with cruise-related mishaps.

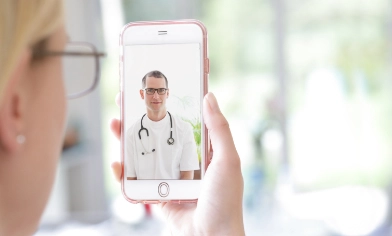

For instance, getting ill at sea might mean you're treated on board first, then need emergency evacuation back to shore. Cruise insurance is there to help in such circumstances.