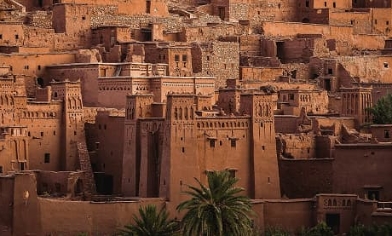

Nature is unpredictable. Extreme weather events are becoming more commonplace. And while natural catastrophes are more likely to happen in some regions of the world it’s impossible to know for sure when and where they’ll occur.

Our travel disruption add-on can bring peace of mind knowing you’re covered if you find yourself at the mercy of Mother Nature before you leave, are in transit or while you’re on holiday.

It defines the following as natural catastrophes:

- Volcanic activity

- Volcanic ash

- Earthquake

- Tsunami

- Hurricane

- Cyclone

- Flooding of more than 50 square km

- Wildfire of more than 50 square km

Natural catastrophe cover can provide reassurance you’ll be covered if such events:

- Disrupt your holiday while you’re already there

- Prevent or delay you getting there by more than 12 hours, or

- Mean you have to turn back home in transit

Whether you need it depends how much you want to leave to chance and what extra reassurance you need. Especially if you’re travelling somewhere with a higher risk of natural catastrophes.